After a good breakout in mid-session, the SPX has reversed and closed near the bottom, belying my re-count intraday; the first attack on the 1434 resistance has failed.

I trade a lot using, as pattern setup, the ascending triangles and the Cup with Handle, and last week I have seen too many of these patterns fail and this is a sign of underlying weakness; Bulls do not have enough conviction or enough munitions to break and maintain positions.

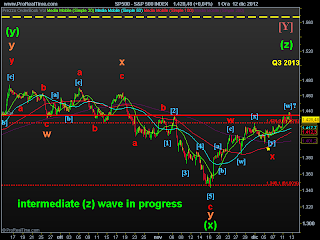

Counts are always unclear but it is possible that we have reached a top of wave [w] of y (double zig-zag pattern).

Important the seals of the supports @ 1424 and especially @ 1418 (Fibonacci price cluster: see 15 min. chart below).

Today Mike Sinibaldi wrote on Twitter: "Permabulls: please post a impulsive count since 11/16 low. I'm dying to see it."

I agree with him, and I wrote in my post on Saturday, December 8 (Elliott Wave Analysis and the KISS principle).

This is and remains a bear market rally, we have to understand of what degree (and what complex pattern it is, maybe a double or a triple zig-zag)

Have a great trading day...with care!

ElwaveSurfer

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.