The preferred scenario, after being weakened by the Wednesday's move, was denied from that of yesterday.

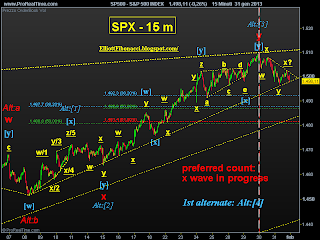

The new preferred scenario considers that occured, on January 30, the top of wave y , and now we are in the wave [a]/[w] of the second wave x of a double zig-zag w-x-y-x-z .

This count would be confirmed by an interesting Fibonacci time cluster at the top of the wave y (which unfortunately I have only seen today) between 100% (bottom wave x - bottom wave x) = red vertical line (dashed) and 261,8% (top wave w - bottom wave x) = white vertical line (dashed).

This count would be confirmed by an interesting Fibonacci time cluster at the top of the wave y (which unfortunately I have only seen today) between 100% (bottom wave x - bottom wave x) = red vertical line (dashed) and 261,8% (top wave w - bottom wave x) = white vertical line (dashed).

Another confirmation is required, with the lack of new highs within a few days.

The new first alternate scenario: we are in Alt:[4] of Alt:c

Possible targets: in 1487-1486 area there is the first Fibonacci price cluster, the second is in 1481-1480 area.

Possible targets: in 1487-1486 area there is the first Fibonacci price cluster, the second is in 1481-1480 area.

The first alternate count could also end today close to 1492 (but this is a hypothesis with low probability).

However, the main trend remain bullish so, even if a top may have occured, I don't open short position on stocks (may be in intraday ES trading).

Have a great trading day...with care!

ElwaveSurfer

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.