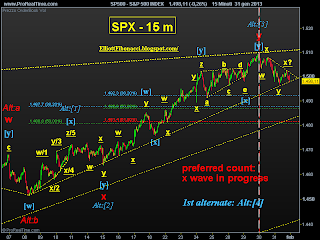

Preferred scenario falters;

the rebound was very strong, has exceeded all Fibonacci's retracements, and seems to have impulsive structure; the market could have completed the wave [a] of [a]-[b]-[c] zig-zag pattern, now downward wave [b] then final rise to end wave b/x with terminal target beyond the previous top.

The previous alternative scenario has lost consistency.

The previous alternative scenario has lost consistency.

Have a great trading day...with care!

ElwaveSurfer